Des Femmes Updates October 2024

A summary of what we learned from Plan B Passport's Bitcoin Inheritance Planning webinar

Sterling here with some amazing knowledge 🙌

Our webinar with Katie Ananina of Plan B Passport was a great success! We learned a bunch not just about Bitcoin inheritance, but about inheritance and estate planning in general.

While this webinar was meant for moms and motherhood-curious folks, everyone should consider what will happen to their assets—whether crypto, fiat, or property.

Takeaways from Bitcoin Inheritance Planning Webinar

Note: the following information applies to residents in the United States. This newsletter is not sponsored by any service providers mentioned.

There are three ways to approach inheritance planning:

Do nothing. If you do not have a written will or plan when you pass away, the probate court will decide who gets what. Oftentimes “next of kin” inherits your assets, whether that be your spouse, your children, or closest living blood relative.

Keep in mind that everything that goes through probate is publicly available information. In other words, the details of your assets (such as your wallet address) will be doxxed. Going through probate can also add to the cost for your survivors.

Create a will. With a will, you can specify who receives what, in addition to when and under what conditions. This may be helpful if you have one family member who is more crypto savvy than others, and you trust them to execute any additional asset distribution.

Even with a will, certain laws will still apply. For example, goodness forbid that you pass before your children reach adulthood, they will not be allowed to access their inheritance (including Bitcoin and crypto) until they turn 18.

Also keep in mind that the details of your will become publicly available because it goes through probate court.

Living revocable trust. A living revocable trust provides greater legal structure to how your assets are distributed, and can be modified throughout your lifetime. Depending on your goals, there are other types of trusts, such as an irrevocable trust and a charitable trust.

A trust is the most private way to plan your inheritance because it does not need to go through probate (unless brought to court). A trust, however, does not provide direction outside of asset management. Only a will includes details such as guardians for minors and funeral instructions.

Wills and trusts are important components of comprehensive inheritance planning, and you will need to work with a lawyer to ensure they’re done correctly.

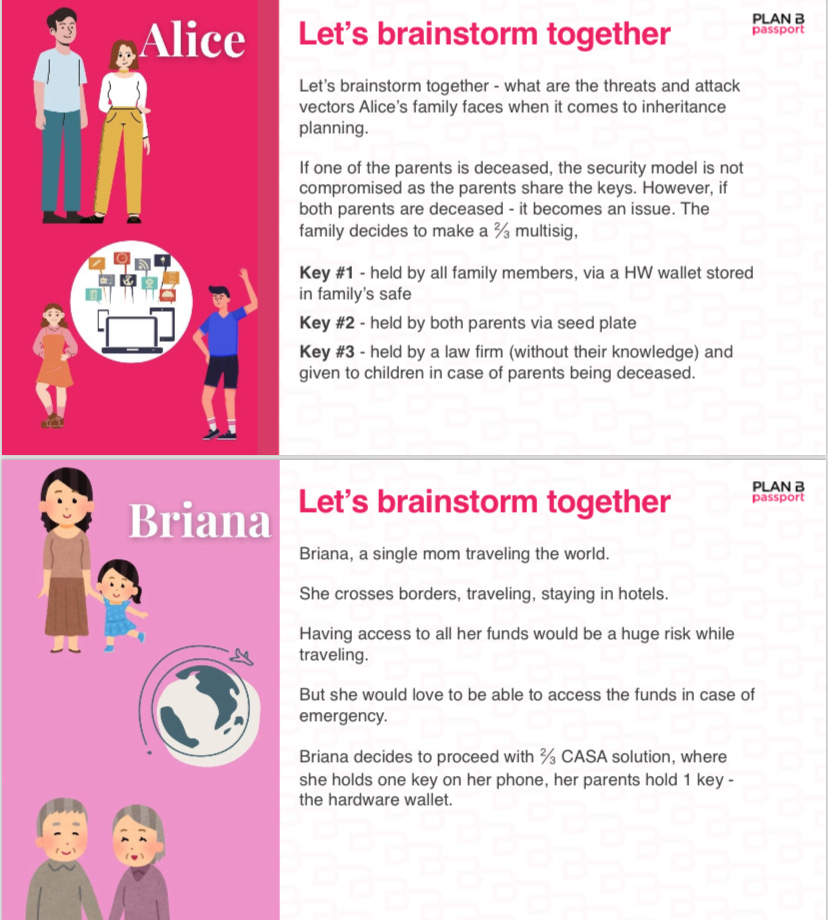

What you can do yourself is choose your Bitcon and crypto solutions. None of this was financial advice, of course, yet we enjoyed brainstorming together what types of solutions might suit different needs.

Bitcoin and Crypto Inheritance Solutions

The first option Katie mentioned was Casa, which offers an inheritance planning service. Their standard option is a 3-key vault: Casa holds 1 key, and you choose who holds the other 2 keys. The vault requires 2 keys, which means Casa can never access your assets. Unchained also offers a 3-key vault, in addition to other financial services such as commercial loans and bitcoin IRAs.

A benefit of using a service like Casa or Unchained is that their teams offer support for non-technical keyholders. They can educate your family on their responsibilities before and after your passing, which can be a huge help when in the midst of their grief.

If you don’t want to use a service, there are other multisig wallet options such as Sparrow and Gnosis (depending on your assets). It’s then up to you to ensure all keyholders are fully aware of their responsibilities and understand how the technology works.

Alternatively, you can keep your bitcoin and crypto in the wallets you use now, and tell your family how they can access the assets after you’re gone.

In the end, it depends on your risk profile and how you talk to family about asset management.

Community Updates and Shout Outs

As we approach the end of our 2024 programming, after four years of freely accessible financial wellness programs for women, we’re winding down for the year and invite everyone who wants to see the online resources continue to offer networking opportunities to share job opportunities, grants, and fundraising opportunities as well.

Looking for work opportunities? Members have shared a number of marketing and engineering roles in our Slack channel!

Add yourself to our database: Crypto, fintech, law, coaching, marketing, publishing, construction, design…whatever your industry or job title, we’d love to add you as a community resource in our member database! These databases and group chats will continue to live on, with any member of the community welcome to add to them.

Until next time, stay curious…